Building a Diversified Trading Strategy Portfolio with AI: A Guide to Smarter Investing

Most traders stick to one or two strategies and wonder why their results stall. Relying on limited approaches leaves you exposed to market swings and missed opportunities. Building a diversified portfolio with AI trading tools like The Trading Hub’s HALO AI engine can change that—offering precision and a range of autonomous trading strategies tailored to your goals. Let’s explore how you can create a smarter, more balanced trading plan that works for you. For more on how to build a diversified portfolio, you can check this guide.

Understanding AI Trading

AI technology is reshaping the trading world, offering tools to create a smarter trading strategy. With AI trading, you gain access to advanced algorithms that analyze data at lightning speed.

Benefits of AI in Trading

AI trading offers several key advantages. First, it minimizes emotional trading decisions, which often lead to losses. By relying on data, AI can make more objective decisions. For example, The Trading Hub’s HALO AI engine processes millions of data points to make informed trading choices.

Another benefit is AI’s ability to work around the clock. Unlike human traders, AI systems never tire, ensuring you don’t miss crucial market moves. This constant vigilance means that your portfolio can be managed effectively even while you sleep.

Finally, AI trading can adapt to changing market conditions. Traditional strategies might falter in volatile markets, but AI can quickly adjust its approach. This flexibility can lead to more stable returns over time, reducing the risk of significant losses.

How HALO AI Enhances Precision

The HALO AI engine takes precision to the next level. It doesn’t just follow pre-set rules; it learns and evolves. With each trade, HALO AI refines its strategy, aiming for more accurate predictions. This dynamic learning process ensures your trades align closely with current market situations.

Moreover, HALO AI’s real-time data analysis offers an edge. It processes information faster than any human could, identifying patterns and trends as they emerge. This quick response helps you stay ahead, maximizing your trading potential.

One standout feature of HALO AI is its ability to execute trades with pinpoint accuracy. By removing human error, it ensures your investments are placed exactly as intended, saving you from costly mistakes. In a world where precision is key, HALO AI stands out as a reliable choice.

Building a Diversified Portfolio

Now that you understand AI’s role, let’s discuss building a diversified trading portfolio. A well-rounded portfolio can buffer against market fluctuations, offering stability in uncertain times.

Importance of Diversification

Diversification is crucial for mitigating risk. By spreading investments across different assets, you reduce the potential impact of a single underperforming trade. According to a recent study, diversified portfolios have a higher chance of maintaining value during downturns.

Think of it like a safety net. If one investment falls, others in your portfolio can support overall performance. This approach helps you weather market storms without significant losses.

Diversification also opens doors to new opportunities. Different assets perform well under varying conditions. By including a mix, you position yourself to capitalize on market shifts, boosting potential returns.

Strategies for Risk Management

Managing risk is a core part of successful trading. Here are three strategies to consider:

-

Asset Allocation: Spread your investments across various asset classes like stocks, bonds, and commodities. This blend can balance risk and reward effectively.

-

Regular Rebalancing: Keep your portfolio aligned with your goals by adjusting asset weights periodically. This ensures you stay on track despite market changes.

-

Using AI Tools: Leverage AI for smarter risk assessments. Tools like HALO AI can analyze risk factors and suggest adjustments to optimize your portfolio.

By implementing these strategies, you’ll create a more resilient portfolio. For more on portfolio diversification, check out this resource.

Autonomous Trading Solutions

With a solid foundation in AI trading and diversification, the next step is exploring autonomous trading solutions. These systems handle trades for you, offering a hands-free experience.

The Role of HALO AI in Automation

HALO AI plays a pivotal role in automating trades. It manages the entire process, from data analysis to execution. This autonomy means you don’t need to monitor markets constantly.

One key advantage is consistency. HALO AI follows a set of rules, executing trades without emotional bias. This approach can lead to steadier performance over time.

Additionally, HALO AI’s adaptability ensures it remains effective in various market conditions. By constantly learning, it stays relevant, offering you a reliable trading partner.

Engaging with The Trading Hub

The Trading Hub makes engaging with AI trading straightforward. Their platform offers user-friendly interfaces and comprehensive support, ensuring you feel confident every step of the way.

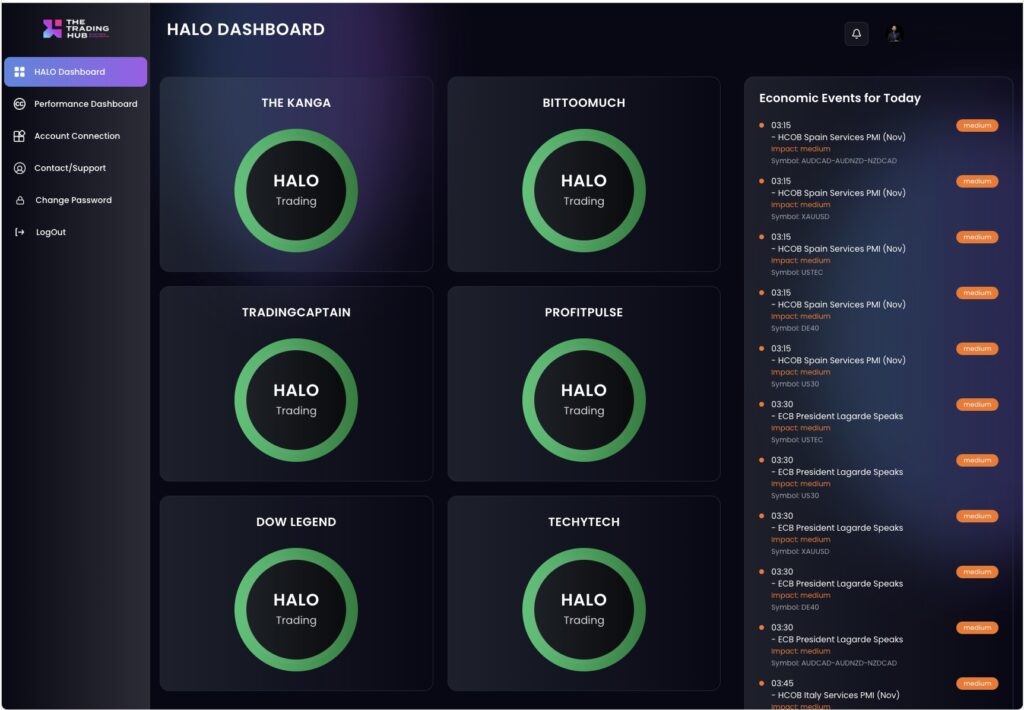

To get started, explore their range of strategies tailored to different goals. Whether you’re looking for conservative growth or bold returns, there’s an option for you. Their Expert Advisors Portfolio showcases various strategies, each powered by HALO AI.

For ongoing support, The Trading Hub provides resources and expert guidance. With transparent pricing and real-time performance data, you can trust in the decisions you make. Embrace the future of trading with confidence, knowing you’re backed by cutting-edge technology.

In summary, AI trading offers a powerful way to build a diversified portfolio that performs well over time. By leveraging tools like HALO AI, you gain precision, autonomy, and peace of mind. Dive into this exciting world and transform your trading experience today.